Our Approach to Impact Reporting

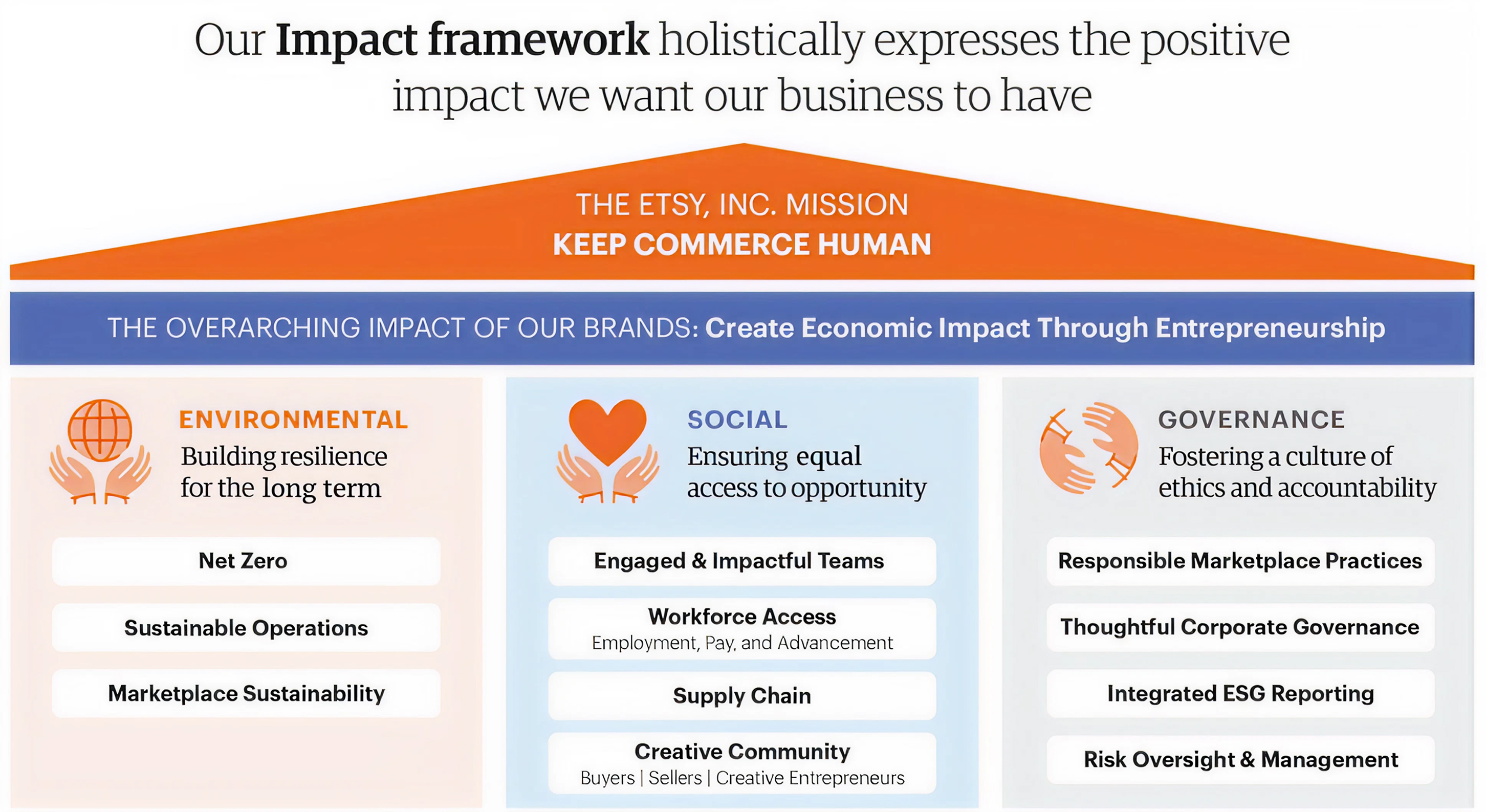

We apply similar focus, discipline, and accountability to our environmental, social, and governance (“ESG”) reporting metrics as we do our financial metrics, and we believe that together they make us stronger and more resilient. We use our required filings with the Securities and Exchange Commission (“SEC”), as well as our Investor Relations website and Etsy News blog, as our primary communications channels for information relating to our Impact strategy and progress. We have various approaches for determining what information we disclose in our ESG reporting, including feedback we receive from the financial community and other stakeholders. In addition, we continue to report our ESG metrics using the relevant Sustainability Accounting Standards Board (“SASB”) sector standards for our industry and Task Force on Climate-Related Financial Disclosures (“TCFD”) frameworks.